Olivier Le Moal

By Jeff Weniger, CFA

The bond market has had a rough two years.

The Bloomberg U.S. Aggregate Bond index started slipping, albeit gently, in August 2020. Last year the grind continued, with the index declining by a not frightful but annoying 1.7%.

Then came 2022.

With the index down by more than 10% this year, bond investors are bracing for a portent that has been rare, at least for as long as I’ve been in this business: three quarters in a row of red ink in the fixed income page of the brokerage statement. It may or may not come to pass – bonds were down 0.06% in July and August, so a little rally in bonds in September would end the streak.

Nevertheless, 2022 has been weird. In “normal” times, bonds would be expected to thrive in a weakening economy. But this year, that old truism has been thrown out the window.

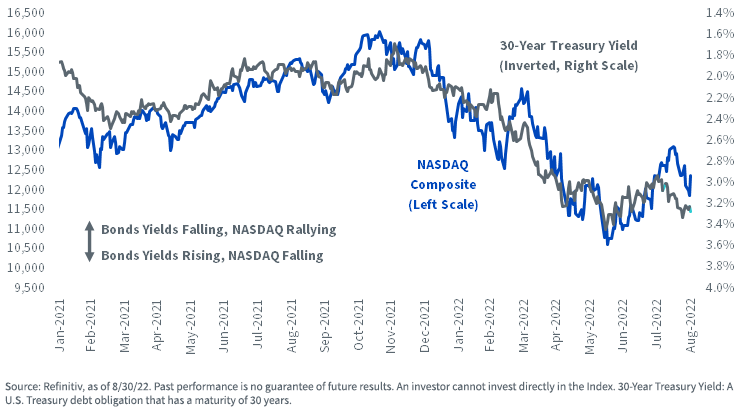

The NASDAQ is taking its cue from the long bond yield. It’s down 23%, and the S&P 500 Growth index is tracking it with a 21% loss. This puts the relative haven status of the S&P 500 Value Index, which is down “only” 7%, into perspective.

Figure 1: The NASDAQ Is Tied to Bond Yields

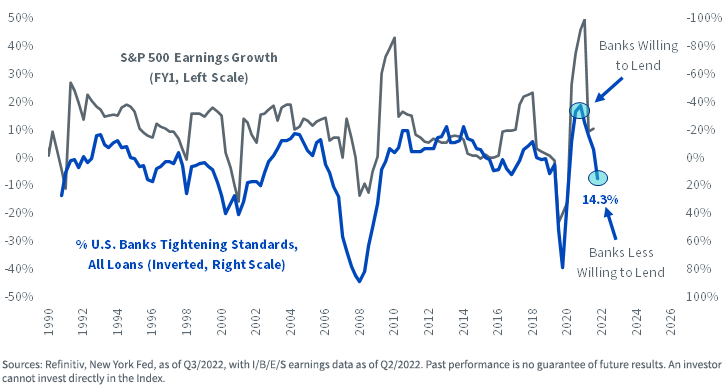

Stock market earnings look suspect. I think that is a problem for the very high beta stocks that tend to populate growth baskets.

Consider this. The New York Fed’s Q3 Senior Loan Officer Survey found that a net 14% of U.S. banks are tightening their lending standards. In figure 2, we can see three episodes over the last quarter century in which that metric has deteriorated from net easing to a net tightening of this severity. Those episodes were in 2000, 2007 and 2020 – all good times to make a prediction that earnings would decline.

Granted, I don’t know if making a comparison to the global financial crisis is warranted at this stage of the game, so take this with a grain of salt. Nevertheless, a scenario that sees S&P 500 earnings growth declining in 2023 is plausible, reasonable and possible.

Figure 2: Tightening of Bank Lending Standards Bodes Ill for S&P 500 Profits

Should that come to pass, we would have a situation where the entire yield curve may be following the Fed higher on rates, while at the same time, equity investors are finding little solace in earnings reports.

We don’t know if current relationships will hold, but it seems to me that if the bond market wants to sell off and S&P earnings want to lay an egg, then growth stocks are a problem child in 2023.

In other words, growth stocks are now the anti-diversification, pro-concentration asset class. As the bond market receives its proverbial margin call, there may come that time that every investor dreads: scanning the holdings list for something to sell.

If it’s the Bloomberg Aggregate that gives investors headaches in the coming months and years, it might just be the NASDAQ-style holdings that meet the sell button. If the bond market’s action continues to punish growth stocks, our dividend strategies may represent something of a shelter.

Unless otherwise stated, data is as of 8/30/22.

Jeff Weniger, CFA, Head of Equity Strategy

Jeff Weniger, CFA serves as Head of Equity Strategy at WisdomTree. In his role, Weniger helps to formulate the firm’s stock market outlook by assessing macro and fundamental trends. Prior to joining WisdomTree, he was Director, Senior Strategist at BMO, where he worked in the office of the CIO from 2006 to 2017. He served on the firm’s Asset Allocation Committee and co-managed the firm’s ETF model portfolios for both the U.S. and Canada. In 2013, at the age of 32, Jeff was chosen as the youngest member of BMO’s Global Investment Forum, which collected the firm’s top global strategists to formulate the firm’s official long-term outlook for investment trends and markets. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He has been a CFA charterholder and a member of the CFA Society of Chicago since 2006. He has appeared in various financial publications such as Barron’s and the Wall Street Journal and makes regular appearances on Canada’s Business News Network (BNN) and Wharton Business Radio.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Stock Market News – My Blog https://ift.tt/E5o4XPV

via IFTTT