Many investors understand the reasons for having a diversified portfolio. One way to accomplish this is to diversify within an asset class. For equity investors in the United States this can mean investing in both growth and value stocks.

Many investors understand the reasons for having a diversified portfolio. One way to accomplish this is to diversify within an asset class. For equity investors in the United States this can mean investing in both growth and value stocks.

It can also mean investing in international stocks. And when investors want to do this, they need look no further than our neighbor to the north. Canada has a range of stocks for investors to consider. This article will focus on strategies that investors can use when looking to invest in Canadian stocks.

Why Buy Canadian Stocks?

There are a few reasons for investors to consider Canadian stocks as part of their diversification strategy:

A Large Natural Resources Sector – The sheer size of the country and its location lets investors know that it is an area rich in natural resources. This also means that the country has a source of current and future wealth.

An Advanced Skills-Based Economy – In this regard, Canada is similar to other western nations. The difference is that it is not as common to find these skill-based professions in a country with so many natural resources.

Stability – Canada is not exempt from any problems that impact the global economy. However, the country is known for stable financial and business policies that have kept the economy relatively stable. This Goldilocks economy has meant that many Canadian stocks haven’t enjoyed the outsized growth of some U.S. equities. However, it also comes with a bit of protection against downside risk.

How Have Canadian Stocks Performed?

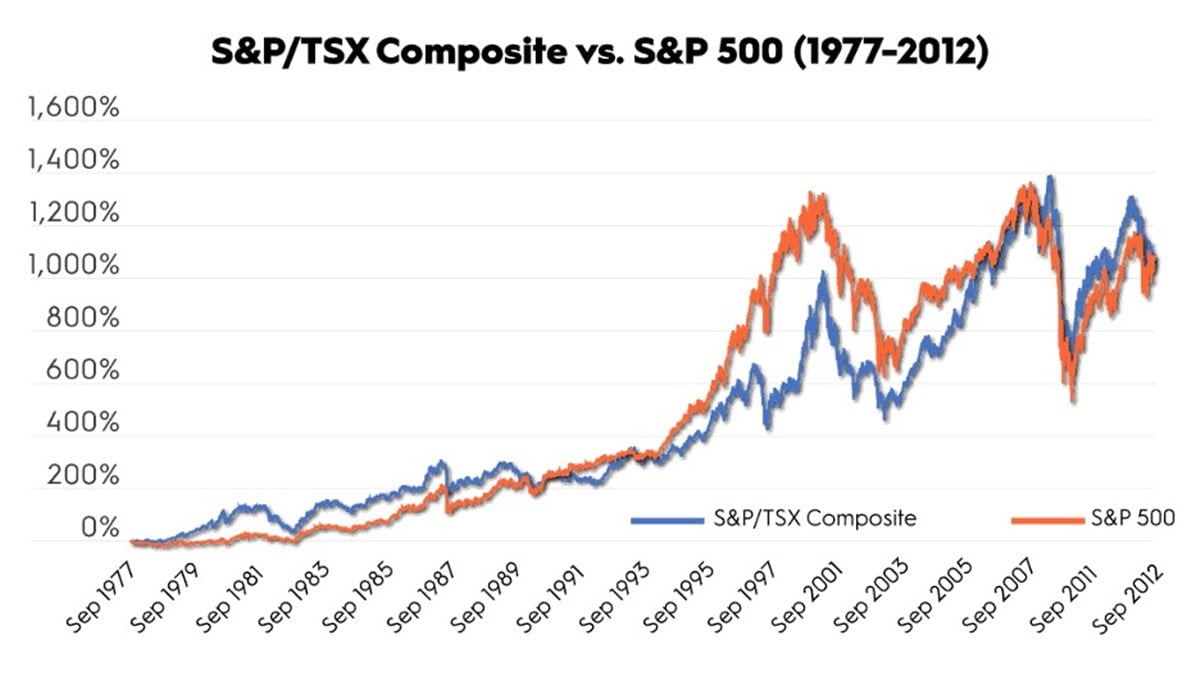

According to S&P Global Market Intelligence, there was a time when U.S. stocks and Canadian stocks performed nearly identically. Here’s a graph that shows the performance of the S&P 500 Index vs. the TSX Index

Ad x1esports

Get Your Portfolio in the Game Today!

This gaming and media portfolio company is bringing a unique rollup strategy and diverse blend of experience brought by its management team to a changing, highly fragmented space.

Source: S&P Global Market Intelligence

You can see that with a couple of exceptions, the two indexes performed remarkably similar. That all changed around 2012 and Canadian stocks became less attractive.

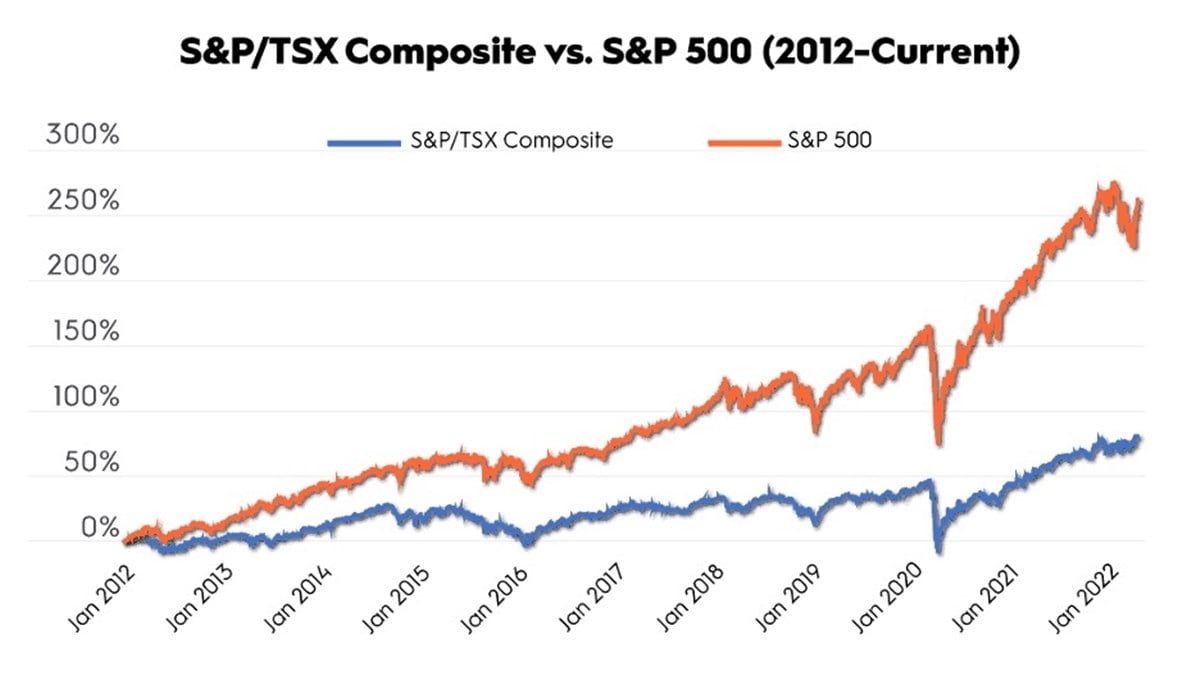

Source: S&P Global Market Intelligence

This disparity is widely due to one sector, technology. However, Canadian technology stocks have been on the rise. And in 2022, the country is benefiting from renewed interest in materials stocks as well as a spike in commodity prices.

What Are the Best Sectors of Canadian Stocks?

For different reasons finance, materials, and energy stocks are among the best performing stocks as of September 2022. Here’s a brief overview of each sector and some of the top names for investors to consider.

Financial – Similar to the United States, Canada has a strong banking industry. Many Canadian banks have a track record of solid performance that can provide long-term value to a portfolio. And several of these stocks pay dividends with attractive yields for investors.

This sector makes up the largest percentage of the TSX at roughly 30%. And the Royal Bank of Canada (NYSE:RY)is the top-weighted constituent in the TSX. Beyond the Royal Bank of Canada some of the other top-performing Canadian financial stocks include:

Materials and Mining – Canadian stocks can be an ideal choice for investors looking to diversify into gold and precious metals without owning the physical metal. Canada has a large natural resources sector. So, it’s not surprising that there are a number of gold mining companies with Canadian origins. This sector also gives investors exposure to other components in the mining and agriculture sectors. This sector makes up approximately 11.5% of the TSX. Some of the top Canadian materials and mining stocks include:

Energy – Canadian stocks offer both traditional fossil fuel-based energy stocks as well as some renewable energy stocks. This sector makes up approximately 18.5% of the TSX. Some of the top Canadian energy stocks include:

Technology – As mentioned earlier, technology stocks have largely been the domain of the United States. As evidence of this, information technology stocks make up only about 5.5% of the TSX. However, there are a few Canadian companies that have become stars in the new economy being created. Some of the more popular names include:

What Are the Risks of Investing in Canadian Stocks?

One concern about investing in Canadian stocks is that they can be heavily weighted towards cyclical industries. For example, as of February 2022 financials (33.5%), energy (14.8%) and industrials (11.7%) made up nearly 60% of the index. That may be too much for some investors particularly because those sectors all tend to correlate roughly the same way as the economic cycle. But as a long-term play, Canadian stocks are worth considering with a small part of your portfolio.

How to Buy Canadian Stocks

Buy Individual Stocks on a Stock Exchange

Hundreds of Canadian stocks have dual listings on either the New York Stock Exchange (NYSE) or the NASDAQ. This is the most convenient way to get exposure to Canadian stocks because there are no barriers to stock ownership. These shares can be purchased in U.S. dollars directly from the exchange just like purchasing a U.S. stock.

However, for a full list of the best Canadian stocks, investors should look at the Toronto Stock Exchange (TSX). The TSX is one of the oldest stock exchanges having been founded in 1852. It’s also the third largest stock exchange in North America in terms of market capitalization.

The Toronto Stock Exchange includes approximately 1,500 companies. It allows investors to trade stocks, investment trusts, exchange-traded products, bonds, commodities, futures, options, and other derivative products. All transactions on the TSX are executed in Canadian dollars.

Invest in a Mutual Fund or ETF

There are many mutual funds and exchange-traded funds that supply exposure to Canadian stocks. Some funds supply exposure to both U.S. and Canadian stocks. Other funds hold just Canadian stocks. Some examples of those include:

- BMO S&P/TSX Capped Composite Index ETF

- Horizons S&P/TSX 60

Index ETF

Index ETF - Vanguard FTSE Canada All Cap ETF

As with investing in any asset class, investors need to consider their investment objective, time horizon and risk tolerance before choosing a fund that fits their needs. Investors will also want to pay attention to the fund’s fee structure to ensure you’re making the most efficient use of your capital.

The Final Word on Investing in Canadian Stocks

Investing in Canadian stocks is one way for investors to add diversification to their portfolio. MarketBeat provides a list of the top Canadian stocks that trade on the TSX. This is Canada’s version of the NYSE or NASDAQ in the United States and includes many of the same stocks.

That’s one advantage of investing in Canadian stocks is that many have a dual listing which removes many of the obstacles that can come with investing in international stocks.

However, investors should be aware that many of the best Canadian stocks are in highly cyclical industries which can lead to underperformance when those sectors are out of favor. Still, due to their relative stability and in some cases an impressive dividend, Canadian stocks may have a place in an investor’s portfolio.

Many of us will read this and be oblivious to the worldwide crisis. But if the current trends continue, it will become real to all of us soon enough. Most of us learned in elementary school that 97% of the world’s water is salt water. And only about 1% of the total water supply is drinkable.

That is becoming difficult math for several areas of the world. A severe, multi-year drought is causing water levels to sink to historically low levels. And the federal government is threatening to cut water use by 25% in the most-affected states of Arizona, California, and Nevada.

And even if we’re not put under water restrictions, we are all likely to see higher costs for food. One reason for that is that about 25% of the nation’s food supply comes from California. An American Farm Bureau Federation survey conducted in 2021 found that 40% of farmers sold off part of their cattle herds.

But opportunities present themselves in the midst of crisis, and this is no difference. In this special presentation, we’re looking at seven water stocks that look like smart buys as the world grapples for solutions.

View the “7 Water Stocks to Buy as the World Dries Up”.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/wEcsulb

via IFTTT